Borrowers can now get financing entirely online without having to go to the lender’s store and fill out a lot of paperwork. Money directly to the bank account!

Title Loan Is The Best Decision

Life can be very difficult because you never know what to expect. That is why sometimes each of us needs funding in order to cope with personal expenses. This can include anything from medical treatment that insurance cannot cover to home renovations or the consolidation of existing debt. However, many Americans cannot manage these expenses on their own. Moreover, if they have a bad credit history, the situation may seem completely hopeless to them.

However, if the borrower owns the title of the car in his own name, then the solution to his problem is quite simple and it is a Title Loan. Lenders work with different types of credit, so the chance of getting approved is quite high.

Toledo Title Loan Basic Data

The Title Loan is a simple secured type of financing that provides borrowers with virtually any type of credit the opportunity to apply for and receive financing for their needs. Since the Title Loan is a secured loan, the title of your car will be the collateral for the loan, which is why the borrower must own it in full in order to be able to apply. He will need to transfer the title to the chosen lender until the debt is fully repaid. Then he will be able to get it back in accordance with the terms of the loan. The repayment period for a Title Loan is typically around 30 days, which means that the Loan is short term and you should make sure you can cover the debt before applying. Some lenders offer Title Installment Loans.

Top Guaranteed Car Title Loan Lender in Toledo, OH

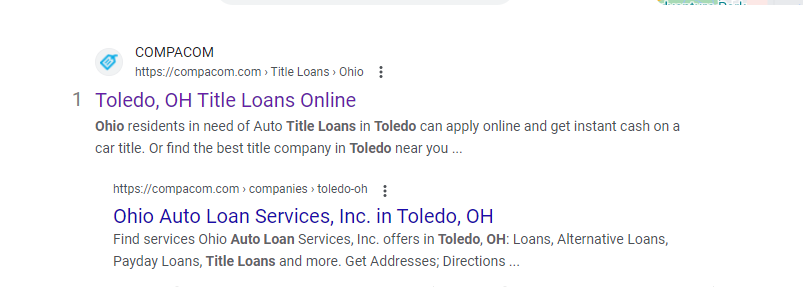

First of all, it is worth noting that guaranteed Title Loans, like other loans, do not exist, as this is too risky for the lender. However, since the Title Loan is secured, it will be fairly easy to get a loan. Below you can look at the best company to get a loan in Toledo.

Compacom. You can also apply for a Title Loan in Toledo, OH on COMPACOM and get approved in less than 30 minutes. You will also be able to keep driving your car and get finance even if you have bad or poor credit history. You will be able to apply both online and in the lender’s store.

Can I Get a Toledo, Ohio Title Loan?

Of course, if you are an Ohio resident you are also eligible to apply for a Title Loan even if you have bad credit. However, you should remember that before you apply, it is a good idea to review the basic eligibility criteria and make sure you meet them. Thus in order to get a Title Loans Online in Toledo you need to:

- Be a US citizen or official resident

- Be at least 18 years of age or older

- Have a regular monthly source of income

- Have a government-issued ID

- Have an active bank account

- Provide phone and email

With this in mind, remember that in order to get a loan in Toledo, you will also need to provide some documents for the car:

- Current vehicle registration

- Original vehicle title with solo ownership

- Government issued identification matching the name on the title

- Vehicle insurance proof

- Proof of residency matching the name on the title

How can I get A Guaranteed Car Title Loan in Toledo, Ohio?

To get a Title Loans Online in Toledo on compacom.com you only need to follow a few simple steps. Below you can explore the main ones:

- Choice of lender. Before applying, it is recommended to study the offers of different lenders in Toledo, compare their interest rates and choose the best offer for you. Above you can take a look at the top 3 lenders in Toledo.

- Application. Visit your chosen lender’s website and fill out a simple online form, providing basic information about yourself such as name, address, income, etc. Most often, this process is as simple as possible and does not take more than 5-10 minutes.

- Physical inspection. After filling out the application, you will need to take your car to the nearest lender’s store in Toledo where a specialist will assess the condition of your vehicle. As a rule, such data as brand, model, mileage, age, cost, condition, etc. are taken into account. If you are applying entirely online, please provide recent photographs of the vehicle as required by the lender.

- Financing. After assessing the cost, the lender will offer you a loan. If you are satisfied with the loan offer, you can sign a contract and receive money for your needs. You can receive money both in the lender’s store and directly to your bank account in the case of an online application.

Can I Get a Toledo Title Loan With Bad Credit?

While many borrowers have doubts about whether they can get financing with bad credit, a lender is more likely to grant a loan if the borrower meets basic eligibility criteria. Since this loan is secured, the lender has a guarantee of the debt repayment. Because if the borrower cannot repay the loan, the lender will be able to take his car in order to consolidate the debt on the loan.